The Impact of Embedded Systems in Digital Finance

The union of finance and technology drives seismic shifts in how we handle money. This fusion has led to a global mass adoption of fintech, wherein in 2021, 76 percent of adults globally will have a bank account.

Fintech has provided unprecedented accessibility to financial services and products for individuals and businesses.

To uncover the profound influence of technology on digital finance, we’ll explore its origin, its current pivotal role in the banking sector, and the dynamic effects it’s precipitating on a global scale.

Whether you’re deeply entrenched in the tech side of finance or simply passionate about the digital metamorphosis underway, this exploration will demonstrate the critical link between embedded systems and the future of finance.

What are embedded systems?

Before dissecting their role in finance, we must first understand what embedded systems are. These systems are specialized computing devices or components of a larger, more complex device or intelligent system. They are dedicated to performing specific tasks and are often tightly integrated into the machinery they manage, hence the term “embedded.”

Typically, they operate under resource constraints; be it limited power, memory, or processing capabilities. Despite these limitations, embedded systems are designed to run without human intervention, reliably executing their assigned functions with minimal downtime.

Key components and how they work

Embedded systems comprise three key elements: hardware, software, and real-time operating systems (RTOS).

The hardware is the physical board or chip that embodies the system’s mechanics, while software, including applications and drivers, brings the system to life.

RTOS is the software core that orchestrates the hardware and application software’s interaction, ensuring that each task executes as intended, on time, every time.

The evolution of embedded systems in tech

In the early days of computing, embedded systems were straightforward. They controlled simple, single-purpose devices like digital watches or vending machines.

However, as technology evolved, so did the complexity and capability of embedded systems.

Today, they’re integral to the functionality of many advanced technologies, from autonomous vehicles to the Internet of Things (IoT).

Embedded Systems in the Financial Sector

The marriage of finance and technology has been a long and fruitful one. Throughout the history of modern financial services, we find that the sector has continuously adopted and adapted to emerging technologies. Embedded systems are the next logical step—seamlessly merging with finance to take it to new, unprecedented heights.

Pioneering digital finance: A historical perspective

The integration of embedded systems in finance is not unprecedented. Consider the introduction of Automated Teller Machines (ATMs) in the 1960s, pivotal in marrying traditional banking with sophisticated embedded technology.

Today, embedded systems catalyze a much more profound shift towards digitization, personalization, and automation in finance.

Embedded systems in modern banking infrastructure

The backbone of contemporary banking infrastructure is an amalgamation of modern technologies, with embedded systems playing a crucial part.

From managing transaction processing to ensuring robust security protocols, these systems are at the core of the financial services industry’s ability to provide reliable and efficient services.

Embedded Systems and Online Banking

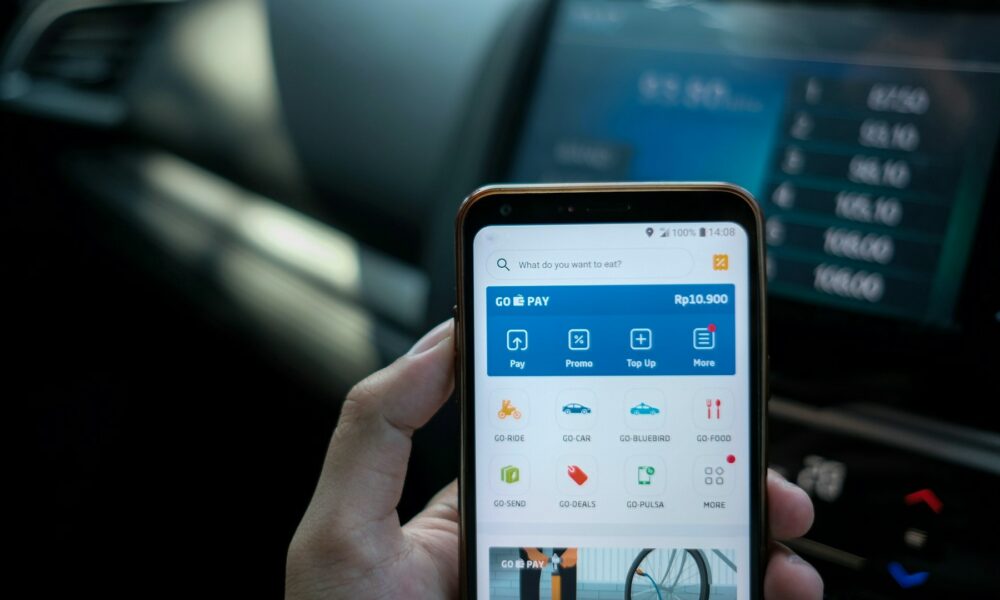

The rise of online banking has revolutionized how we manage our money. Convenience, flexibility, and the ability to conduct financial transactions from the comfort of one’s home have driven the rapid adoption of digital banking solutions. Embedded systems are instrumental in ensuring online banking’s prowess.

The backbone of online banking platforms

Without embedded systems’ reliability and real-time responsiveness, the complex network of online banking services would falter. These systems maintain the integrity of the banking experience, enabling functions like fund transfers, bill payments, and account management to occur seamlessly and securely.

Ensuring secure and efficient online transactions

One of the most significant challenges in the online banking realm is security. Embedded systems continually monitor for fraudulent activities, encrypt sensitive data, and ensure that multi-factor authentication processes remain swift and user-friendly.

Enhancing user experience in digital banking

Beyond security, embedded systems elevate the user experience by enabling features such as predictive analytics for personal financial management tools, which enhance customer engagement and satisfaction.

Integrating Online Banking Services

For online banking to be genuinely transformative, its various services must seamlessly integrate, providing a holistic and user-centric financial experience. Embedded systems are the invisible architects behind this integration.

The seamless integration of online banking services

From linking checking and savings accounts to integrating financial management apps, embedded systems work tirelessly behind the scenes. They ensure all your financial data and operations are in sync, regardless of the platform or device you use. This allows for a seamless and convenient banking experience for customers.

How embedded systems facilitate online checking accounts

Embedded systems play a vital role in streamlining the operation of a checking account online, ensuring users can manage their finances easily and efficiently.

These sophisticated systems automate the intricate processes behind account monitoring, transaction verification, and balance updates. By doing so, they secure the digital banking environment and provide real-time financial information, making managing a checking account online convenient and reliable.

Enhancing the security of online banking

Account security is a non-negotiable aspect of digital finance. Embedded systems implement and optimize sophisticated security measures, evolving alongside cyber threats to keep your money safe.

From multi-factor authentication to encryption technologies, these systems work in the background to identify and prevent unauthorized access, secure your personal information and transactions, and protect against fraud.

Finance has transcended geographical boundaries, becoming a global domain. Embedded systems have been instrumental in democratizing access to financial services and shaping the economic landscapes of emerging and developed economies.

Embedded systems in emerging markets

In emerging markets, where traditional banking may be sparse, embedded systems empower the underserved with secure and user-friendly digital financial services, potentially jump-starting economic growth.

Embedded systems in developing economies

Embedded systems are also accelerating the modernization of financial operations in developing economies, making transactions more efficient and transparent.

The broader implications for global finance

The role of embedded systems in finance goes beyond the sum of their parts. They are agents of change, affecting global economic indicators and shaping the financial habits of individuals and institutions worldwide.

The Continuing Evolution of Finance Technology

The only constant in the world of finance technology is change, and embedded systems play a critical role in developing cutting-edge financial technologies.

We are on the cusp of an era where financial services will be seamlessly integrated into our daily lives, thanks in no small part to embedded systems that underpin the technology driving these services forward.

In conclusion, the impact of embedded systems in digital finance is profound and multifaceted. Their invisible presence is the fabric that binds and empowers the cutting-edge financial services that are shaping our economic future.

Understanding this critical role is paramount for anyone seeking to remain relevant in the evolving digital economy. Whether you are a developer, entrepreneur, or end-user, insight into embedded systems is the heart of digital finance’s future.